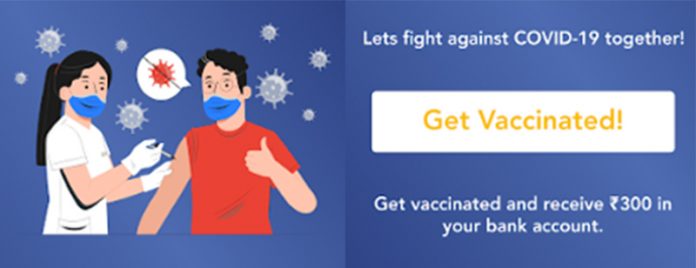

BharatPe launches ‘Covid Vaccination Cashback’: Rolls out initiative to encourage Covid-19 vaccination for merchants

- Merchants to get Rs. 300 into their bank account for getting fully vaccinated

- Merchants can figure out Covid-19 Vaccine Slots and Venues within BharatPe App

Chennai, BharatPe, one of India’s leading fintech company for merchants, today announced the rollout of its unique campaign to further strengthen the Indian government’s vaccination drive against COVID19. Launched under ‘BharatPe Cares’, a corporate social responsibility initiative by BharatPe, this first-of-its-kind of programme aims to create awareness about Covid-19 vaccination amongst the company’s 6 million+ merchant partners and also encourage them to get vaccinated without delay. In India’s first vaccination Cashback program, BharatPe merchants will get an Rs. 300 instant cash back in their bank account by scanning their vaccination certificate via the BharatPe app.

The company also announced the launch of a Covid-19 Vaccine Tracker on its app to facilitate relevant information on Covid-19 vaccination. By using this Vaccine Tracker, the merchants can view details of the nearby Covid-19 Vaccination Centers, based on their location. Also, they can choose to get notified when a slot is available in their chosen area.

Sharing details about the campaign, Ashneer Grover, Co-Founder & CEO, BharatPe said “The shopkeepers in India have played a significant part during Covid by ensuring availability of essentials. It’s time now for them to start working towards unlocking. BharatPe is incentivizing all shopkeepers to get vaccinated at the earliest so that they stay safe as business picks up and footfalls at shops increase. It’s time to get back to business.”

BharatPe is committed to make financial inclusion a reality for small merchants and kirana store owners in the country. The vision of the company is become a Digital Bank and empower the 50 million-strong SME community in the country by launching a range of financial products, specially designed to address their needs and empower their businesses.